Pretend you’re standing in the middle of the exhibition hall at URTeC. You’re surrounded by companies showcasing their newest technology:

VR goggles to view seismic.

Terabytes of real-time well data on an iPad.

DNA testing for oil.

Forget about your AFEs–buy it all!

In the cold light of day (or your home office), you remember that budgets exist, and for good reason.

It’s easy to forget that this industry is a delicate balancing act between rocks, hydrocarbons, and money.

Money drives almost all of the decisions around how to manage an asset.

Need to pay your bills by the end of the month? Open up your well and let it flow so you can sell the oil!

Planning to sell your asset in five years? Let the wells flow so you can show potential buyers a high IP.

Planning to give these wells to your grandkids? Slow and steady wins the race.

Oh, today the price of oil is negative? Dial back the choke size and make a plan to store the oil in your swimming pool.

It’s no secret that oil and gas is a roller coaster industry and companies need to be nimble.

Using well test data to optimize completions and production for future wells is a game-changer. Revo Testing Technologies is at the forefront of this space, providing well testing and engineered flowback solutions for today’s market.

The Origin Story

Revo’s founder and CEO, Darryl Tompkins and Alex Bergman, both come from military backgrounds and are intensely passionate about their fields.

Darryl was a technician in the Canadian Navy, which he describes as “a couple of guys in a canoe.” After leaving the Navy, he earned a degree in mechanical engineering from the University of Windsor in Ontario, Canada.

His dad worked for an oil & gas operator and introduced Darryl to the industry through a series of co-op roles.

After some engineering roles in the conventional and offshore world, Darryl took a new position as a reservoir engineer doing gas storage projects. Craving the excitement of unconventionals, he took a field engineering role with Halliburton in Alberta.

After a few years, the intensity of field life became “rather tiresome” (a Canadian way of describing it) and Darryl moved back to reservoir engineering. He moved to Houston to work with Halliburton’s DFIT (Diagnostic Fracture Injection Test) team.

What is a DFIT?

DFITs are essentially a mini-frac: pump a small amount of liquid and see how it leaks off. This will tell you how the rock reacts and can be used to design the entire frac treatment for the well. During the early years of the unconventionals boom, DFITs were popular. As operators began to learn how their assets behaved, DFITs faded into a one-per-section test, and eventually dropped off the map after the 2014 downturn.

Naturally, Darryl began to think: what next?

At the time, Darryl was still working for Halliburton. He began to develop optimized flowback, but the idea never gained traction within Halliburton.

Anyone who has worked for a massive company can relate. As Darryl put it, his optimized flowback ideas were a tiny piece of the giant Halliburton pie.

So in 2017, he left Halliburton and started the company that would eventually become Revo Testing Technologies.

Meanwhile, Alex Bergman was working as a manager at CSL Capital Services, an investment firm in the energy services and equipment space.

Alex also started his career in the military as an engineering officer for the U.S. Coast Guard.

After ten years in the Coast Guard, Alex went to business school and moved into the private equity world.

He worked for SCF Partners (an energy services and equipment investment firm) for two years before moving to Rockwater Energy Solutions.

At Rockwater, he further developed his engineering operations leadership skills, serving as the regional vice president for Rockies operations. Alex was very experienced in the well testing and flowback field, particularly on the hardware and operations side.

The two met when Alex was the managing director at CSL.

By then, Darryl had founded Revo Testing Technologies and was raising capital.

In January 2020, Alex came to Revo as the CEO, joining Chief Technology Officer Darryl.

Revo’s Technology

Revo’s flowback and well testing technology falls into three categories: hardware, software, and consulting.

But first, what is well testing and flowback?

Well testing and flowback are part of the production phase of a well’s life.

There are many types of well tests, but they all do the same thing at the end of the day: record a well’s pressure and volumetric flow rate to capture the reservoir’s capacity to produce hydrocarbons.

Well tests require highly-trained field personnel, and labor is one of the highest costs in the process.

Flowback is the initial phase of a well’s production.

The goal of flowback is to manage the fluid (a mixture of oil, water, gas, and sand) from the well and make sure debris doesn’t get into the separator once the well is on production. Debris includes sand, frac plugs, and other completions equipment.

Flowback operators play an essential role in this phase: troubleshooting any equipment problems, recording flow rates, coordinating transport trucks on location, and keeping the well flowing.

Well testing and flowback have traditionally been analog processes and Revo is here to modernize that.

Hardware

Alex is the hardware guy–the one who took dummy iron and made it smart. He saw the opportunity to improve existing flowback hardware by adding HSE features, improving separator efficiency, and automating measurements.

A unique feature is that Revo’s spread is 100% electric and emission-free.

Eliminating emissions is safer for field personnel and is an easy way to address ESG concerns.

Revo has implemented other safety features to eliminate the need for a slow manual response to pressure emergencies and has removed field personnel from the red zone by automating data measurement.

Automation ensures accurate and consistent data measurements.

They designed a proprietary separator that is more efficient than the ones on the market today. The separator measures data with higher accuracy and actually saves operators money by separating fluids more efficiently.

Consulting

How does all of this super accurate data get used?

That’s where Darryl comes in.

It’s quite common for operators to collect all of this data without having the time or interest to make sense of it.

Revo started as a consulting/reservoir engineering platform and took an analytical approach to help operators understand how to produce their wells.

Revo’s clear, accurate data helped operators understand how completion design changes affected well performance without waiting for six months or a year of production data.

Revo also showed operators how to optimize their production practices to avoid damaging the well in the initial production phase.

Software

Revo’s consulting services quickly took off and they shifted to include a SaaS model.

Their software provides on-demand access to well testing data and visualization, eliminating data management headaches. It puts the power back in the operators’ hands to control their wells.

Helping E&P’s Improve Assets

Every operator has a different way of measuring a well’s success: EUR, NPV, recovery factor, IRR.

The delicate balancing act between rocks, hydrocarbons, and money.

EUR is a standard KPI, especially for public companies, but type curves are often off base.

Wells in the same area are expected to follow the same type curve, but they don’t.

Revo wants to improve this.

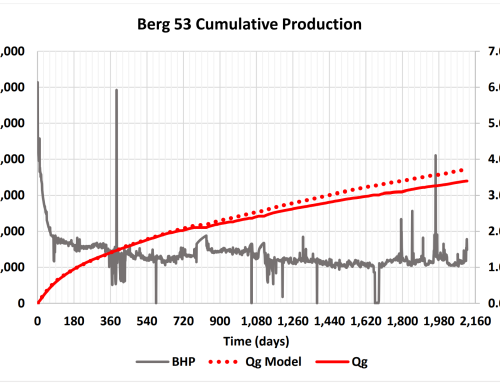

They estimate EUR using a year of production data, compare neighboring wells’ performance, and relate flowback data to the one-year cumulative production.

From this, they can infer that what they see on flowback will be directly proportional to differences in EUR between wells in an asset.

Operators now have a better workflow for calculating type curves, estimating EUR, and managing their assets.

Managing an asset for the long haul has suddenly become a priority for some operators, thanks to 2020.

Back in the day, operators would open up the choke as much as possible to have an attractive IP for the quarterly reports.

Operators who flipped assets also weren’t too concerned with managing choke–they just wanted to get the well up and running so they could sell it.

The 2014 downturn, the double black swan events of 2020, and increasing pressure from Wall Street have changed many operators’ outlooks.

Now the focus is on asset longevity.

This industry loves to talk about finding sweet spots and here, the sweet spot is flowing back a well as fast as possible without damaging the wellbore.

Revo’s diagnostics and workflows lead operators to that sweet spot.

The future may be unpredictable, but the future of your wells doesn’t have to be.

Listen to Revo Test on the Oil and Gas Startups podcast.

Leave A Comment